If you aren’t tracking and processing manufacturer buydown rebates, your convenience store is missing out.

Processing manufacturer buydowns—incentives extended to retailers for a finite period of time by (mostly) tobacco manufacturers—are an often-overlooked revenue source for convenience stores. In this scenario, a set of existing inventory items (often cigarettes) are placed on sale, with the price reduction getting passed through from the tobacco manufacturer to the retailer to the consumer. The goal is to stimulate sales. Often promotional considerations such as special signage and displays are part of the deal.

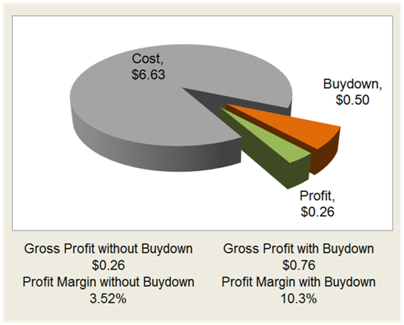

Why are manufacturer buydowns overlooked? For starters, we can’t ignore the fact that the convenience store, under a buydown agreement, extends the discount to the customer immediately, but won’t get reimbursed immediately. So the operator needs to stay on top of the manufacturer to make sure they get what is owed to them long after the POS transaction has been consummated. Some owners forget to follow up. Others can’t figure out how to book the discounts and reimbursements correctly for tax compliance and other purposes. Still others, particularly those that aren’t making full use of convenience store automation, find the effort too much of a bother for what looks like a relatively small amount per transaction.

Why are manufacturer buydowns overlooked? For starters, we can’t ignore the fact that the convenience store, under a buydown agreement, extends the discount to the customer immediately, but won’t get reimbursed immediately. So the operator needs to stay on top of the manufacturer to make sure they get what is owed to them long after the POS transaction has been consummated. Some owners forget to follow up. Others can’t figure out how to book the discounts and reimbursements correctly for tax compliance and other purposes. Still others, particularly those that aren’t making full use of convenience store automation, find the effort too much of a bother for what looks like a relatively small amount per transaction.

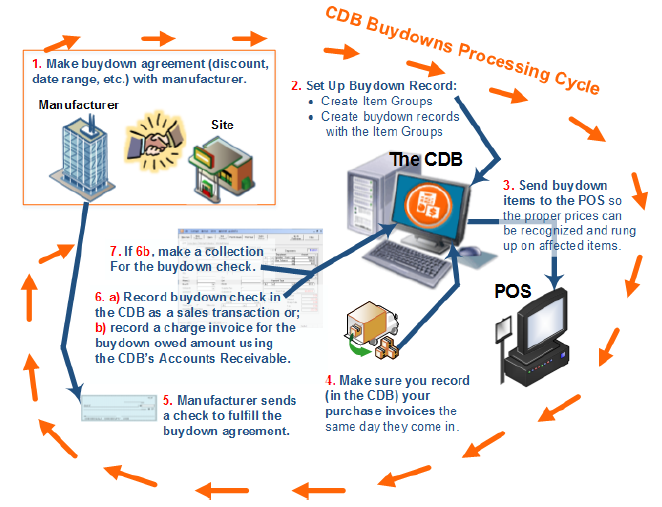

As you can see from above, this is a process with many moving parts. Just looking at it can give the uninitiated a headache. But despite this, astute convenience store owners know full well that the “small amounts” of a buydown rebate, if ignored, can add up and adversely impact store revenue potential. This is why SSCS introduced a comprehensive solution to track and manage buydowns in our Computerized Daily Book (CDB) back office system.

As you can see from above, this is a process with many moving parts. Just looking at it can give the uninitiated a headache. But despite this, astute convenience store owners know full well that the “small amounts” of a buydown rebate, if ignored, can add up and adversely impact store revenue potential. This is why SSCS introduced a comprehensive solution to track and manage buydowns in our Computerized Daily Book (CDB) back office system.

The CDB lets you set up buydowns quickly and easily from the moment that manufacturer drops off promotional signage and program descriptions. At the heart of SSCS’ automated system for buydowns are the following:

- The ability to create a buydown record for a user-defined set of items complete with the date range it is active.

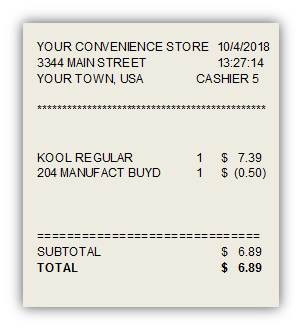

- The capacity to send all buydowns to the point-of-sale so that itemized receipts display customer rebate calculations.

- Links between the buydowns system and vendors, so that collection notices can easily be distributed when the time comes to collect reimbursements.

- Flexible options for tax collection on buydowns, so that you can charge sales tax for the full list price, or the list price minus the buydown. Your choice.

The bottom line here is that if your manufacturer is offering promotion-related reimbursements, you need a completely systematic way of tracking the money that they subsequently owe to you. And with SSCS technology, you have a solution that not only lets you track buydowns, but every single penny, nickel, can, bottle, and transaction that comes through your store. Think of it as mining gold nuggets with an extremely sophisticated gold pan kit.

The bottom line here is that if your manufacturer is offering promotion-related reimbursements, you need a completely systematic way of tracking the money that they subsequently owe to you. And with SSCS technology, you have a solution that not only lets you track buydowns, but every single penny, nickel, can, bottle, and transaction that comes through your store. Think of it as mining gold nuggets with an extremely sophisticated gold pan kit.

If SSCS Technology as it applies to the buydown process looks like something you would like to investigate for you store, but you don’t know where to start, if you are an SSCS user we have good news for you. We’ve just released a video that covers all the setup basics in an easy-to-understand format, which you can find here. May we also add that our online help and documentation also do an excellent job of providing an overview and walking you through the process.

Good luck mining for that additional buydown revenue!

Leave A Comment