Redemptions look insignificant at the POS—but they add up quickly when mismanaged.

When Oregon became the first state to pass Bottle Deposit legislation in 1971, the act set off a chain reaction that would eventually span to a widespread U.S. program to incentivize recycling—a program that now spans eleven states, not to mention most of the countries in Europe, as well as Israel, Japan, and Fiji.

While not all U.S. states have come onboard with the program, and Bottle Deposits and Redemptions remain a contentious political issue in many U. S. regions, some of America’s most populous states have adopted it. That means the vast array of businesses that sell beverages in bottles and cans—like convenience stores!—need a mechanism for tracking Redemption amounts on receipts, and making sure Redemption deposits are factored into store key performance indicators (KPIs) like profit margins and department sales performance.

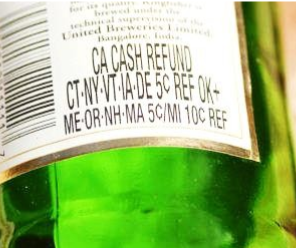

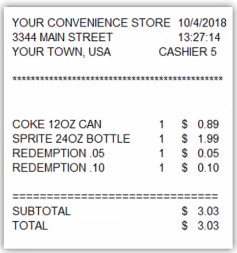

One of the more important aspects of managing Redemptions for the convenience store, is passing the bottle and can deposit cost down to your customers in a clear and explicit way. Shelf tags, after all, represent the price of the product before Redemptions are applied. Redemption quantities appearing on receipts are designed not only to explain why additional costs have been added to (for instance) a packaged beverage. They’re also there to remind consumers that they can get cash back from the dump or recycling center if they want to redeem the money they paid for their deposit amount.

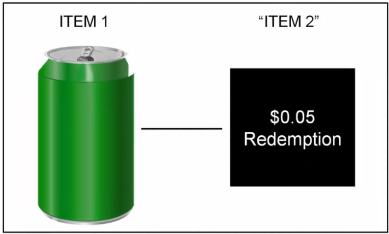

SSCS software, specifically the Computerized Daily Book (CDB), has made it easy to set up and manage Redemptions so you don’t slowly leak profit each time one of these so-called “small” values is recorded in your store. Each item (for instance soda) that you sell is linked with a secondary “item,” namely the Redemption for which you charge your customers a deposit for the can or bottle. This item relationship is sent to your point-of-sale (POS), so that each time a customer buys a Redemption item, the Redemption amount is clearly displayed on the receipt. Meanwhile, in the software, expenses and purchases related to Redemptions are tracked separately from a (for instance) Packaged Beverages department’s profit margins. Redemptions shouldn’t affect profit margins or expenses. And in our software suite, they don’t.

Redemptions, ultimately, are about more than accounting and doing business. They are state and national programs designed to inspire consumers to put reusable materials back into circulation, rather than landfill. By having a strong system for accounting for them and processing them, you can keep your inventory selling seamlessly and follow your state’s regulations, as well. Plus you are more assured that your bottom line isn’t affected adversely by the misrepresentation of these specific values.

Because SSCS believes Redemption handling is an overlooked strength of the CDB and SSCS-related software, we’ve produced a video to show you how simple it is to use. If you are an SSCS user, please check out our new video at https://portal.sunrayasp.com/setup-redemptions—a complete overview of how to get started which, in turn, is part of a longer series on setting up every aspect of our system at your site.

Leave A Comment