Unbreakable: The Science of Supply Chain Management

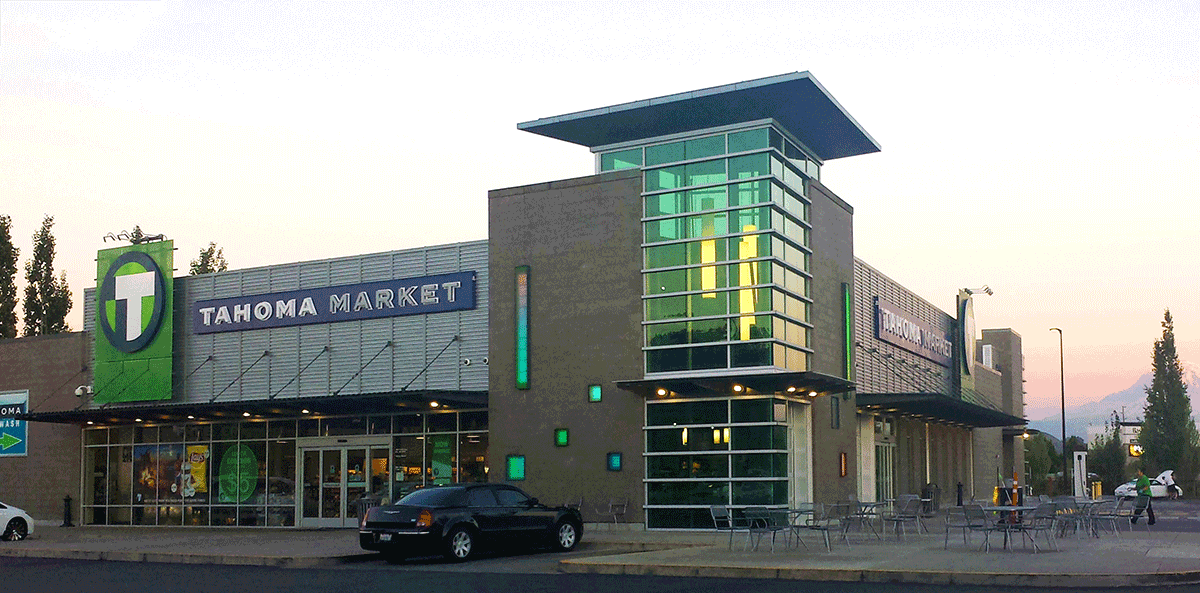

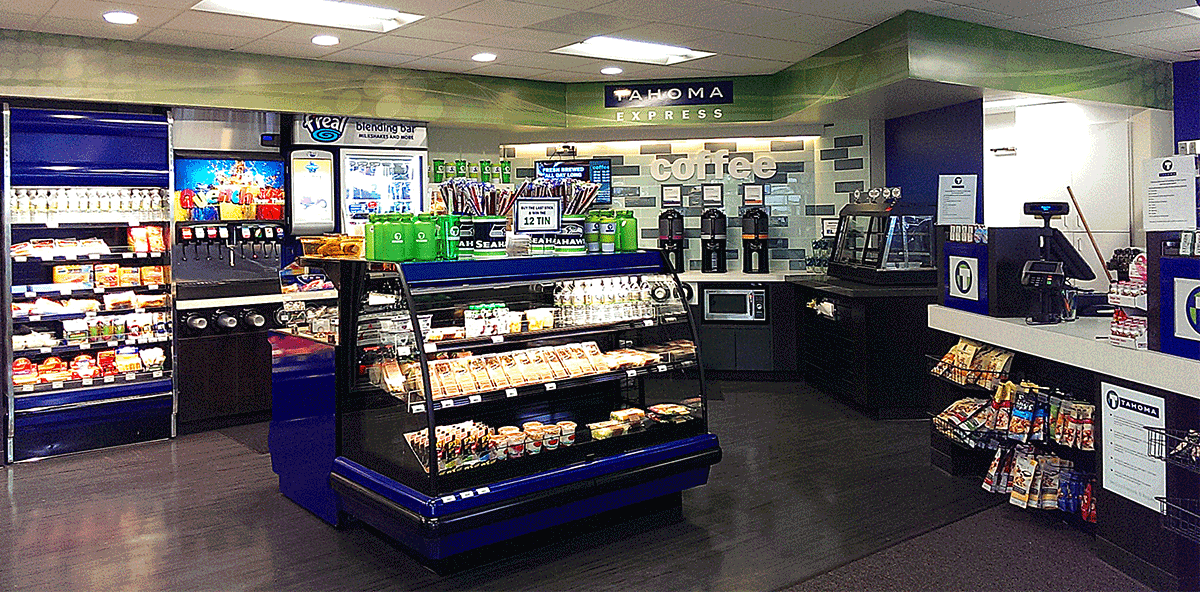

Successful stores all have one thing in common—a strong supply chain. Tahoma Market is no exception thanks to Joe Oakes, his team, and the pervasiveness of SSCS technology.

Part 1 of this profile introduces us to the Tahoma Market brand and philosophy of service. Find it here.

Nothing better illustrates the preparation and focus that Marine View Ventures (MVV) poured into creating store procedures for its re-launched brand, Tahoma Market, than its structured, scientific approach to supply chain management.

In simplest terms, supply chain management means getting the right products in the right quantities from Point A (often a vendor or supplier) to Point B (most often the hands of a customer at the POS). The process touches upon enough of the C-store’s daily sub-procedures that it can be visualized as a structural backbone running through the operation.

“Successful stores have one thing in common—a strong supply chain,” says Oakes, “Without one in place, the store loses focus and procedures begin to fall apart.”

For MMV, a strong supply chain starts with professional inventory and strong inventory management, then progresses into procurement, price book, marketing and merchandising. Separate departments within Oakes’ supply chain team are assigned to each of these functions. SSCS technology plays a supporting role in most.

Last week we touched upon the key role the Computerized Daily Book (CDB) back office system played in Tahoma Market’s initial classification of a profitable inventory mix with consistent, predictable pricing across all stores (2,000–2,500 unique SKUs in the Express locations and 2,700-3,200 in the big store). With the right products identified, MMV moved to further shore up the supply chain by removing the responsibility for purchasing from individual store managers and placing it with MMV’s supply chain team.

“Getting purchasing out of the store helped us standardize ordering for the entire enterprise,” explains Oakes. “In addition, it freed up the store managers to spend more time attending to the needs of customers and employees. With the CDB, the purchasing team can always see what items we currently have and what we need to order. We can project our buys and make sure what we purchase provides the best ROI.”

To get pricing in line, MMV turned to SSCS’s Central Price Book (CPB). The software extends the functionality of the CDB with enterprise-wide control over the company’s price book. In the past the enterprise had struggled to keep their pricing timely and uniform. CPB gives Tahoma Market the ability to set up zone pricing across the enterprise and make sure that when prices change at one store, they are pushed out at the same time to the others.

When MMV felt confident that it had secured control over pricing, purchasing, and procurement, the company began to organize the inventory earmarked for each store in as similar a physical arrangement as possible, creating a sense of familiarity through easily located product.

While painstaking preparation has had much to do with Tahoma Market’s achievements, maintaining excellence requires a daily effort. Oakes starts every morning looking at reports output by SSCS’s Transaction Analysis, a web-based application that captures actionable information from major point-of-sale (POS) systems.

“Transaction Analysis gives us a receipt by receipt view of what’s happening at the register,” says Oakes. “It’s an easy way to see how many refunds, returns, and overrides occurred the day before and who was responsible. It helps keep employees accountable.”

As Oakes reviews register transactions, Tahoma Market’s buyers run the CDB’s Inventory Value report to identify slow movers and dead stock. The information assists in keeping the company’s site inventory databases as pristine as possible. Armed with this knowledge, the buyers use the system to create purchase orders automatically based on previously set quantity thresholds, transfer them electronically to vendors, and get a buy cut in a short amount of time. In addition, the CDB alerts staff when minimum and maximum quantities are reached, values based on the Tahoma team’s own input.

At the same time this analysis and adjustment is going on, the price book team is logging onto Central Price Book to view the pricing profiles of each item, reviewing margins and related values to see if anything impactful occurred that needs immediate attention. “We look to see if we’re adhering to our pricing policies, if active promotions are still working correctly, if someone has gone in and changed a price of which we were not aware—and that’s just the surface,” says Oakes. “We might also pull the Daily Book Analysis report—a summary of the store’s daily activity—to see if our overall margins fall with within tolerance levels. If they don’t, we’ll pull up the offending line items in Central Price Book, see if we’ve priced something too low or too high, and adjust it.”

Analysis of the supply chain continues into the afternoon as buyers, the price book team, and inventory personnel take a look at where performance lines up in terms of monthly and annual goals and whether Tahoma Market is making progress or getting behind in meeting them. For example, the procurement desk must see how any new order affects the organization in terms of its monthly goals and opens to buy. The price book team must verify if items received meet margin goals. If no orders are generated that day, overview reports for MTD/QTD or YTD are run.

Based on this feedback, adjustments are made on the fly. These include increasing prices, if needed; pulling discontinued product off the floor to stop margin erosion; making decisions on slow turning items to see if they have a future on the shelves as well as fast turning items to make sure stores are meeting demand. If a site has run out of an item, the transferral of stock to whatever store needs it is quickly initiated.

Tahoma Market’s supply chain manager, who reports directly to Oakes, puts the information from SSCS technology together and runs it through Tahoma Market’s own proprietary application to organize and highlight data that is then reported up to the board. At the end of the month the accounting team takes that data and puts it into their profit and loss report—calling attention to anything that might have been previously missed—which gets reported up to the Tribal Council.

Oakes’ style is not only proactive, but collaborative. “Based on our daily findings I’ll pull vendors and buyers together to discuss everything from floor stacks to cooler stock levels,” he explains. “These discussions build on success, improve mutual opportunities, and help us do a better job of reaching our goals to the fullest.”

Oakes’ style is not only proactive, but collaborative. “Based on our daily findings I’ll pull vendors and buyers together to discuss everything from floor stacks to cooler stock levels,” he explains. “These discussions build on success, improve mutual opportunities, and help us do a better job of reaching our goals to the fullest.”

Though the application of supply chain management to the convenience store model is a driving force behind the success of Tahoma Market, C-store chains often have trouble pulling it off in quite the same way. “The larger grocery stores do well as they have access to and are informed about the resources and tools they need,” notes Oakes. “The convenience store industry, especially smaller operators, may not have this luxury and instead rely on vendors to assist with the composition of their price book. Sometimes it works well, but vendors ultimately have a vested interest in selling particular products, which is an issue. More importantly, they don’t have the understanding of the store that we do.

“When you take the supply chain inside the organization you have better control. You know your store; you’ve studied it at length, and can make informed decisions based upon this deep level of knowledge. The tools are there—SSCS technology is a case in point—and if you find the personnel that can master those tools you’ll have great outcomes. You just have to make sure that everyone is pulling the same data and looking at it the same way using the same options provided by the software. Luckily, a little communication is usually all it takes to solve most problems.”

Marine View Ventures continues to enjoy much success with the revitalized Tahoma Market brand. Waste and spoilage are down. Margins are up. Discussions about the addition of a new store are taking place.

“There’s no doubt that it’s easier to align our process with procedure by having a single standardized way of doing things instead of multiple systems handling different pieces of the organization,” Oakes concludes. “We’ll continue to refine our approach as our brand grows and increases in visibility. SSCS technology will be a big part of that. I always find myself telling the team to ‘Let SSCS handle that.’ The breadth of functionality that the software offers to operators is incredible. The tools really do contribute to the strength of our brand.”

Leave A Comment